And What Does It Mean For The Future Of Wall Street?

If you’ve paid any attention to the news over the past few days, you have most probably heard that there’s something huge going on within the stock market, in a situation which Wall Street commentators have referred to as ‘a phenomenon’, ‘insane’ and like ‘nothing we have ever seen’ – and it all began with amateur traders and a struggling video game store.

So, what exactly is going on with GameStop and the stock market, and what lasting effects will it have on Wall Street as a whole?

How It Started

It was no secret that GameStop, an American high-street games, consoles and electronics store, was struggling due to the COVID-19 pandemic. Having been on a steady decline for the last few years, due to the rise of online shopping and video game downloads, being forced to close for the foreseeable future due to Coronavirus appeared to be the final nail in the coffin.

This was a fact picked up on by Wall Street traders, who often take a gamble on the stocks of seemingly ill-fated companies in a process known as ‘short selling’. Short selling is essentially the process of borrowing shares in a company to sell them, with the promise to the original holder that they will buy these shares back at a later date – the hope being that by the time the traders buy the shares back to return them, they will be available to buy at a lower price.

Short sellers had identified GameStop as a struggling company and set their sights on acquiring GameStop shares under the assumption that there was a healthy profit to be made when buying them back. Unfortunately for them, this hadn’t gone unnoticed.

What is r/wallstreetbets?

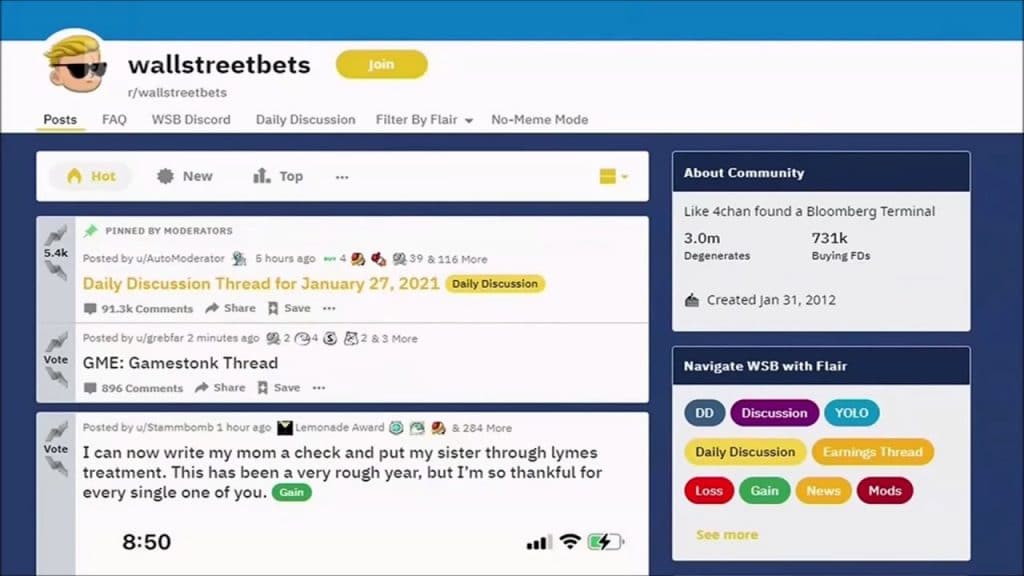

r/wallstreetbets is a community on the forum site Reddit, made up of users looking for news, hints and updates on stock market opportunities. A user on the forum had shared that he had purchased shares in GameStop stores in the belief that the shares were highly undervalued and that there was plenty of money to be made, should the price of the stock raise as he was expecting.

Discovering that GameStop had become a prime target for short-selling investors, users on the site decided to band together, purchases shares of their own and drive up the price of GameStop stock – wreaking havoc on the plans of the short-selling investors who had predicted that GameStop was set to fail.

What Happened?

Due to the efforts of the r/wallstreetbets community and the sudden influx of GameStop shares being purchased, the price of stocks in GameStop to increase by over 1500% in the weeks leading up to January 27th. Even last January, before the impact of the Coronavirus pandemic, GameStop shares were available for around $3.50 a piece – by January 27th 2021, a single share in GameStop was worth $325.

This caused what is known as a ‘short squeeze’. Seeing the price of the shares rise so sharply, those who had bet on GameStop’s failure were quickly forced to buy shares to return to those they had borrowed from – and with the price continuing to rise, they needed to act fast in order to prevent further greater losses. Some hedge funds (trading partnerships who practice short-selling, often gambling multi-millions of dollars at a time) claim to have lost up to $13bn to the GameStop short squeeze.

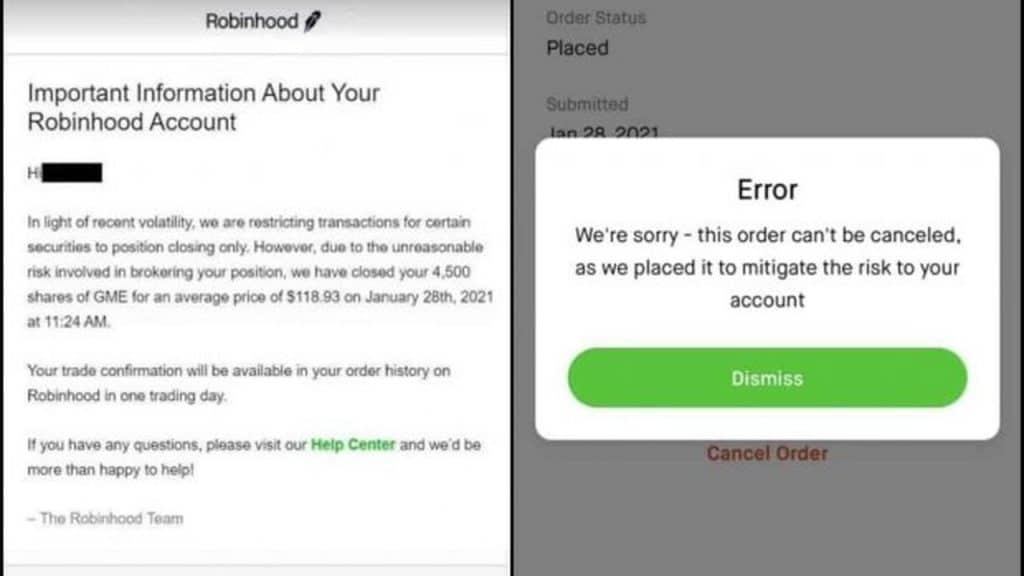

The squeeze even prompted stock-trading app Robinhood to halt all trading of GameStop shares through their service. This prompted a furious backlash, as the company could be seen to be manipulating the stock market by doing this. This also led to widely-circulated accusations of hypocrisy after a Twitter user shared a screenshot of a post made by Robinhood in 2015 declaring that ‘one of (our) strongest beliefs’ is that ‘everyone should be able to participate in the stock market’.

What Does This Mean For The Future Of Wall Street?

As the price of GameStop stock continues to rise and investigations into the phenomenon are launched, we’re yet to see what the lasting effects of the short squeeze will be. Many suspect it will leave investors thinking twice about the safety of short-selling in the future, having now seen how easily the process can be upended. It’s also believed the short squeeze could lead to a rise in the number of those with no experience trading stocks getting involved in the market for the first time in the hope of making serious money.

As for those who were influenced to buy GameStop shares due to the conversations on Reddit, many of them claim they were not financially motivated.

“Obviously, we all know that these stocks are not the best stocks,” GameStop investor Kristen Servidad told BBC News, “But the whole point of this is not necessarily evaluating the stocks, it’s to drive the price up and send a message.”

“Your average Janes and Joes are struggling during COVID-19, and I think this shows that, if we take control as a collective and work as a group, we could have the same buying power as the big cats upstairs.”

As of yet, little is known about what the long-term future of GameStop, short-selling or even Wall Street will look like – only when the share prices begin to move back down to a normal level will experts be able to ‘take stock’ of what is left behind.

DON’T MISS OUT: Elevate your dinner party game in 2021 with this design trend